Understanding the Average APR for Tribal Loans: A Professional Guide

Navigating the landscape of personal finance, especially when facing urgent needs and limited traditional options, can be complex. Tribal loans have emerged as a significant, albeit often controversial, segment of this landscape. For many, the critical question revolves around their cost: What is the average Annual Percentage Rate (APR) for tribal loans?

Unlike conventional lending, pinpointing a definitive "average APR" for tribal loans is notoriously challenging due to their unique regulatory environment, diverse lending practices, and the high-risk profile of their target borrowers. This guide will provide a professional, step-by-step exploration of tribal loans, their APRs, the factors influencing them, and crucial considerations for anyone contemplating such a financial product.

1. What Are Tribal Loans? An Introduction

Before delving into APRs, it’s essential to understand what tribal loans are and how they operate.

1.1 Definition and Origin

Tribal loans are a type of short-term, high-interest installment loan offered by lending institutions owned and operated by Native American tribal governments. These lenders typically operate online, making them accessible to a broad demographic, including individuals in states where payday lending is restricted or illegal.

1.2 The Principle of Sovereign Immunity

The core characteristic that sets tribal loans apart is the concept of sovereign immunity. Federally recognized Native American tribes are considered sovereign nations, meaning they are not subject to state laws, including state usury caps (limits on interest rates). This allows tribal lenders to offer loans with APRs that would be illegal for traditional lenders in many states.

1.3 Purpose and Target Audience

Tribal loans are generally marketed as a solution for individuals needing emergency funds who may not qualify for conventional bank loans, credit union loans, or even traditional payday loans due to poor credit history or other financial challenges. They are often presented as an alternative to payday loans, offering longer repayment terms (e.g., several months to a year) but often at comparable, or even higher, effective annual rates.

2. Understanding APR: The Cost of Borrowing

APR, or Annual Percentage Rate, is a critical metric for understanding the true cost of any loan.

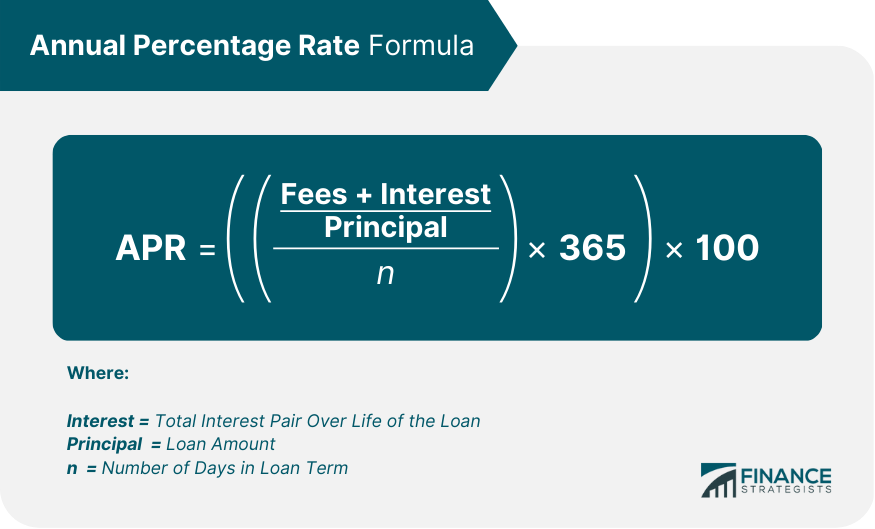

2.1 Definition of APR

APR represents the total cost of borrowing money over a year, expressed as a percentage. It includes not only the interest rate but also any additional fees associated with the loan, such as origination fees or processing fees. This standardized measure allows consumers to compare the true cost of different loan products.

2.2 Why APR is Crucial for Tribal Loans

Given the high-interest nature of tribal loans, understanding and calculating the APR is paramount. Without it, the seemingly manageable bi-weekly or monthly payments can obscure the exorbitant total cost of the loan over its term.

3. The APR Landscape for Tribal Loans: A Wide Spectrum

Unlike traditional financial products where average APRs might fall within a relatively narrow range, tribal loan APRs are characterized by their extreme variability and high ceilings.

3.1 No Single "Average"

It’s crucial to state upfront: there isn’t a universally agreed-upon "average APR" for tribal loans. This is due to several factors:

- Lack of Centralized Reporting: There’s no single regulatory body compiling and reporting data across all tribal lenders.

- Diverse Lending Models: Each tribal lender operates independently, setting its own rates and terms.

- Individual Borrower Profiles: APRs are highly dependent on the borrower’s creditworthiness, the loan amount, and the repayment term.

3.2 Typical APR Ranges

While an exact average is elusive, based on industry reports, consumer complaints, and lender disclosures (where available), tribal loan APRs typically range from 200% to 900%, and sometimes even exceeding 1000% or more.

To put this into perspective:

- Credit Cards: Average APRs typically range from 15% to 30%.

- Traditional Personal Loans: Can range from 5% to 36% for borrowers with good credit.

- Payday Loans: Often have APRs in the 300% to 400% range for a typical two-week loan.

The significantly higher potential APRs for tribal loans highlight their extreme cost compared to most other forms of credit.

4. Key Factors Influencing Tribal Loan APRs

Several variables contribute to the exceptionally high and varied APRs seen with tribal loans.

4.1 Lender’s Risk Assessment

Tribal lenders primarily target borrowers with poor credit scores or limited credit history. These individuals are considered high-risk, as they are more likely to default on their loans. To offset this increased risk, lenders charge significantly higher interest rates, which directly translates to a higher APR.

4.2 Loan Amount and Term

- Smaller Loan Amounts: Often carry disproportionately high APRs when calculated annually, even if the dollar amount of interest seems small for a short term.

- Longer Repayment Terms: While a longer term might mean lower individual installment payments, the total interest paid over the life of the loan can be substantially higher, potentially leading to a higher effective APR depending on how it’s structured.

4.3 Lack of State Usury Laws

As mentioned, sovereign immunity allows tribal lenders to bypass state-specific interest rate caps. This freedom from state regulation enables them to set rates far exceeding what would be legal for traditional lenders, directly contributing to higher APRs.

4.4 Lender’s Operating Costs and Business Model

Online lending platforms, customer service, loan processing, and managing high default rates all contribute to the operational costs of tribal lenders. These costs are often passed on to borrowers through higher interest rates and fees.

4.5 Market Demand and Vulnerability

Tribal lenders operate in a niche market serving individuals who are often desperate for funds and have few other options. This demand, coupled with the borrowers’ vulnerability, allows lenders to charge premium rates.

5. Illustrative Examples of Tribal Loan APRs

To further clarify the concept, let’s consider hypothetical scenarios.

5.1 Scenario 1: Short-Term, High-Fee Loan

- Loan Amount: $500

- Loan Term: 2 weeks

- Fee/Interest: $75 (to repay $575)

- Calculation: ($75 / $500) (365 days / 14 days) 100% = 391% APR

While this APR is high, many tribal loans offer longer terms with even more aggressive fee structures that can push the APR much higher.

5.2 Scenario 2: Installment Loan with Multiple Payments

- Loan Amount: $1,000

- Repayment Term: 6 months (12 bi-weekly payments)

- Total Repayment: $2,500 (meaning $1,500 in interest/fees)

- Calculation (Approximate): This scenario could easily result in an APR well over 400-500%, depending on the exact payment schedule and how interest accrues. The total cost of $1,500 on a $1,000 loan over six months clearly demonstrates the rapid accumulation of debt.

These examples are illustrative. Actual APRs can vary dramatically based on the specific lender, loan agreement, and the borrower’s individual circumstances.

6. The Risks and Considerations of High APR Tribal Loans

While tribal loans may offer quick access to funds, their high APRs come with significant risks.

6.1 The Debt Trap

The most significant risk is falling into a debt trap. With extremely high APRs, borrowers often find it difficult to repay the principal and interest on time. This can lead to:

- Rolling over the loan: Paying only the interest/fees and extending the loan, incurring more charges.

- Taking out new loans: Borrowing from another lender to pay off the first, spiraling into deeper debt.

- Default: Inability to pay, leading to collection efforts and potential damage to credit.

6.2 Exorbitant Total Cost

Even a small loan can balloon into a massive repayment obligation due to compounding interest and fees. A borrower might end up paying several times the original loan amount.

6.3 Limited Consumer Protection and Recourse

Due to sovereign immunity, tribal lenders may not be subject to state consumer protection laws. This can make it challenging for borrowers to seek recourse in case of disputes, predatory practices, or if they feel they have been treated unfairly.

6.4 Impact on Credit Score

While some tribal lenders do not report to major credit bureaus, defaulting on a tribal loan can lead to collections activity, which will negatively impact your credit score.

7. Navigating Tribal Loans: A Prudent Approach

If you are considering a tribal loan, extreme caution and due diligence are essential.

7.1 Read the Fine Print Meticulously

Understand every clause of the loan agreement. Pay close attention to:

- The stated APR: This should be clearly disclosed.

- All fees: Origination fees, late payment fees, rollover fees, etc.

- Repayment schedule: Exact dates and amounts for each payment.

- Total cost of the loan: The sum of all payments over the loan term.

- Default consequences: What happens if you miss a payment or cannot repay.

7.2 Calculate the Total Cost

Don’t just look at the monthly or bi-weekly payment. Multiply the number of payments by the payment amount to understand the total financial commitment. Compare this to the original loan amount.

7.3 Verify Lender Legitimacy

While sovereign immunity provides legal protection, ensure the lender is genuinely affiliated with a federally recognized tribe. Look for clear contact information, a physical address, and reviews (though be wary of overly positive or negative unverified reviews).

7.4 Understand Your Recourse

Inquire about the lender’s dispute resolution process. If they claim sovereign immunity, understand what that means for your ability to seek legal remedies if a problem arises.

7.5 Assess Your Repayment Capacity Honestly

Before committing, realistically evaluate whether you can afford to repay the loan in full and on time, without needing to roll it over or take out another loan.

8. Exploring Safer Alternatives

Given the high costs and risks associated with tribal loans, it is always advisable to explore alternatives first.

8.1 Traditional Personal Loans

- Banks and Credit Unions: Offer personal loans with significantly lower APRs (typically 5-36%) for borrowers with good to excellent credit.

- Online Lenders: Many online platforms offer personal loans with competitive rates for various credit scores, though they may not be as accessible to those with very poor credit.

8.2 Payday Alternative Loans (PALs)

Offered by federal credit unions, PALs are designed to be a safer alternative to payday loans. They have capped APRs (currently 28%) and more reasonable repayment terms.

8.3 Secured Loans

If you have collateral (like a car title or savings account), a secured loan can offer lower interest rates because the lender’s risk is reduced.

8.4 Borrow from Friends or Family

While not always an option, borrowing from trusted individuals can provide much-needed funds without interest or rigid repayment terms.

8.5 Community Assistance Programs

Many local charities, non-profits, and government agencies offer assistance for rent, utilities, food, or other emergency needs.

8.6 Credit Counseling

If you’re struggling with debt, a non-profit credit counseling agency can help you create a budget, negotiate with creditors, and explore debt management plans.

8.7 Building an Emergency Fund

For long-term financial stability, building an emergency fund is crucial to avoid reliance on high-cost loans during unexpected financial crises.

9. Conclusion: Prudence is Paramount

The question "What is the average APR for tribal loans?" doesn’t have a simple answer. Instead, it points to a reality of extremely high and widely varying rates, typically ranging from 200% to 900% or even higher. These rates are a direct consequence of tribal lenders’ sovereign immunity, the high-risk profile of their borrowers, and the lack of state-level regulatory oversight.

While tribal loans can offer a quick solution for those with limited options, they come with substantial risks, most notably the potential for a spiraling debt trap. A professional approach to personal finance dictates that such loans should be considered only as a last resort, after all safer and more affordable alternatives have been thoroughly exhausted. Financial literacy and due diligence are your strongest allies in navigating this complex and high-stakes lending environment.