Here is a 1200-word article reviewing the best mortgage options for tribal members, including pros, cons, and purchase recommendations.

Navigating the Path Home: A Comprehensive Review of Mortgage Options for Tribal Members

Homeownership is a cornerstone of the American Dream, representing stability, wealth building, and a place to nurture family and community. For Native American tribal members, this dream often comes with unique complexities and opportunities, largely due to the distinct legal and land status of tribal lands. While the general mortgage landscape offers various paths, understanding which options are best suited for tribal members requires a deeper dive into specialized programs and considerations.

This comprehensive review will explore the leading mortgage options available to tribal members, examining their advantages and disadvantages, and providing tailored recommendations to help navigate the journey to homeownership.

Understanding the Unique Landscape: Trust Land vs. Fee Simple

Before delving into specific mortgage products, it’s crucial to understand the fundamental difference between "trust land" and "fee simple" land.

- Trust Land: This land is held in trust by the U.S. government for the benefit of Native American tribes or individual tribal members. It is not owned outright by the individual in the same way as fee simple land. This status has significant implications for mortgages, as lenders cannot directly foreclose on trust land in the traditional sense. Mortgages on trust land typically involve leasehold interests, where the homeowner leases the land from the tribe or the individual allottee.

- Fee Simple Land: This is land owned outright by an individual or entity, similar to most private property across the United States. Mortgages on fee simple land follow conventional lending rules.

Many tribal members live on or wish to build on trust land, making specialized programs essential. However, many also live off-reservation or on fee simple land within reservation boundaries, where conventional options may be more accessible.

Review of Best Mortgage Options for Tribal Members

Let’s examine the primary mortgage options, focusing on their relevance and applicability to tribal members.

1. HUD Section 184 Indian Home Loan Guarantee Program

Overview: The HUD Section 184 program is arguably the most significant and tailored mortgage option for Native American and Alaska Native families. It’s a loan guarantee program, meaning HUD guarantees the loan for approved lenders, reducing the risk for the lender and making homeownership more accessible. It is specifically designed to work with the unique legal status of tribal lands, including trust land.

Pros:

- Tailored for Trust Land: This is its most significant advantage. It explicitly addresses the complexities of financing homes on trust land, working with leasehold interests.

- Low Down Payment: Typically requires a down payment of just 2.25% for loans over $50,000, and 1.25% for loans under $50,000.

- Flexible Underwriting: Offers more flexible credit guidelines compared to conventional loans, acknowledging the unique financial histories that may exist within tribal communities.

- Competitive Interest Rates: Rates are often comparable to, or even lower than, conventional market rates.

- No Private Mortgage Insurance (PMI): Instead, it has a one-time upfront guarantee fee (1.5% of the loan amount, can be financed) and a small annual servicing fee (0.25% of the outstanding balance). This can result in lower monthly payments than FHA loans.

- Versatile Use: Can be used for purchasing an existing home, constructing a new home, rehabilitating a home, or refinancing an existing mortgage.

- Assumable: The loan can be assumed by another eligible Native American/Alaska Native borrower.

- Nationwide Availability: While specific to Native Americans and Alaska Natives, it is available across the U.S., including on and off reservations.

Cons:

- Limited Lender Pool: Not all lenders offer Section 184 loans. Borrowers may need to seek out specialized lenders familiar with the program.

- Tribal Participation Required (for Trust Land): For homes on trust land, the tribal government must have an approved Section 184 agreement with HUD.

- Slightly Longer Processing Times: Due to the specialized nature and coordination required (especially on trust land), processing can sometimes take longer than conventional loans.

- Eligibility Restrictions: Only available to enrolled members of federally recognized tribes.

2. VA Loans (Department of Veterans Affairs)

Overview: VA loans are a benefit for eligible active-duty service members, veterans, and surviving spouses. While not specific to tribal members, many Native Americans serve in the U.S. armed forces, making this a highly valuable option.

Pros:

- 0% Down Payment: The most significant advantage, requiring no money down for eligible borrowers.

- No Private Mortgage Insurance (PMI): Similar to Section 184, VA loans do not require monthly PMI, leading to lower monthly payments.

- Competitive Interest Rates: Often offers some of the lowest interest rates available.

- Flexible Credit Requirements: Generally more lenient on credit scores compared to conventional loans.

- Limited Closing Costs: Lenders are restricted on what closing costs they can charge.

- Assumable: VA loans are assumable, even by non-veterans, which can be an attractive feature for future buyers.

- VA Native American Direct Loan (NADL): A specific VA program that helps Native American veterans finance the purchase, construction, or improvement of homes on Federal Trust Land. It’s a direct loan from the VA, not a guarantee, offering very favorable terms.

Cons:

- Eligibility Restricted: Only available to eligible veterans, service members, and surviving spouses.

- VA Funding Fee: Most borrowers pay a funding fee (a percentage of the loan amount) which can be financed into the loan. This fee can be waived for veterans with service-connected disabilities.

- Property Requirements: Homes must meet VA appraisal standards (Minimum Property Requirements – MPRs).

- NADL Limitations: While excellent, NADL has specific requirements, and the property must be on trust land.

3. FHA Loans (Federal Housing Administration)

Overview: FHA loans are government-insured mortgages that are popular for first-time homebuyers due to their lower down payment requirements and more flexible credit criteria. They are not specific to tribal members but can be a good option for those on fee simple land or for properties that meet FHA standards.

Pros:

- Low Down Payment: Requires a minimum down payment of just 3.5% of the purchase price.

- Flexible Credit Requirements: FHA is known for being more forgiving of lower credit scores compared to conventional loans.

- Competitive Interest Rates: Often offers favorable rates, though usually slightly higher than VA or Section 184.

- Assumable: Like VA and Section 184, FHA loans are assumable.

Cons:

- Mortgage Insurance Premium (MIP): Requires both an upfront MIP (1.75% of the loan amount, can be financed) and an annual MIP, which, for most FHA loans, is paid for the life of the loan, regardless of equity. This significantly increases monthly costs.

- Property Standards: Homes must meet FHA appraisal standards, which can sometimes be more stringent than conventional appraisals.

- Loan Limits: FHA loans have limits based on the county, which may restrict options in higher-cost areas.

- Not Designed for Trust Land: While not explicitly prohibited, FHA loans are not structured to easily accommodate the complexities of trust land and leasehold agreements, making them less practical for such properties.

4. USDA Rural Development Loans (United States Department of Agriculture)

Overview: USDA loans are designed to help low- and moderate-income individuals purchase homes in eligible rural areas. Many tribal lands and surrounding communities fall within USDA-eligible zones.

Pros:

- 0% Down Payment: A major benefit, similar to VA loans.

- No Private Mortgage Insurance (PMI): Instead, there’s an upfront guarantee fee (1% of the loan amount) and an annual fee (0.35% of the outstanding balance), which are significantly lower than FHA’s MIP.

- Flexible Credit Requirements: Generally more lenient on credit than conventional loans.

- Competitive Interest Rates: Often offers favorable rates.

Cons:

- Geographic Restrictions: The property must be located in a USDA-eligible rural area. While many tribal lands qualify, it’s not universal.

- Income Limits: Borrowers must meet specific income limits for the area, which can vary.

- Property Requirements: The home must be modest and meet USDA appraisal guidelines.

- Not Ideal for Trust Land: Similar to FHA, USDA loans are not specifically designed for the complexities of trust land and leasehold interests.

5. Conventional Loans

Overview: Conventional loans are offered by private lenders and are not insured or guaranteed by the government. They are the most common type of mortgage for borrowers with strong credit and down payments.

Pros:

- Flexible Terms: A wider variety of loan terms (e.g., 10, 15, 20, 30-year fixed, adjustable-rate mortgages).

- No PMI with 20% Down: If you put down 20% or more, you avoid PMI. If less, PMI is typically required but can be canceled once 20% equity is reached.

- Wider Lender Pool: Most banks and mortgage companies offer conventional loans.

Cons:

- Stricter Credit Requirements: Generally require higher credit scores and lower debt-to-income ratios than government-backed loans.

- Higher Down Payment: Typically require a larger down payment (often 5-20%) to avoid PMI or secure the best rates.

- Significant Challenges on Trust Land: This is the biggest hurdle. Conventional lenders are often hesitant or unable to finance homes on trust land due to the lack of direct collateral and the complexities of tribal law and leasehold agreements. They are best suited for tribal members purchasing fee simple land.

- Appraisal Issues: Appraisals on tribal lands can be challenging due to a lack of comparable sales data.

Key Considerations for Tribal Members

Beyond specific loan products, several factors are uniquely important for tribal members seeking homeownership:

- Land Status is Paramount: Always determine if the property is on trust land or fee simple land first. This will dictate which mortgage options are even viable.

- Tribal Housing Departments: Many tribes have dedicated housing authorities or departments. These are invaluable resources, offering guidance, financial literacy education, and sometimes even their own tribal housing programs or down payment assistance. They can also facilitate the necessary tribal approvals for Section 184 loans on trust land.

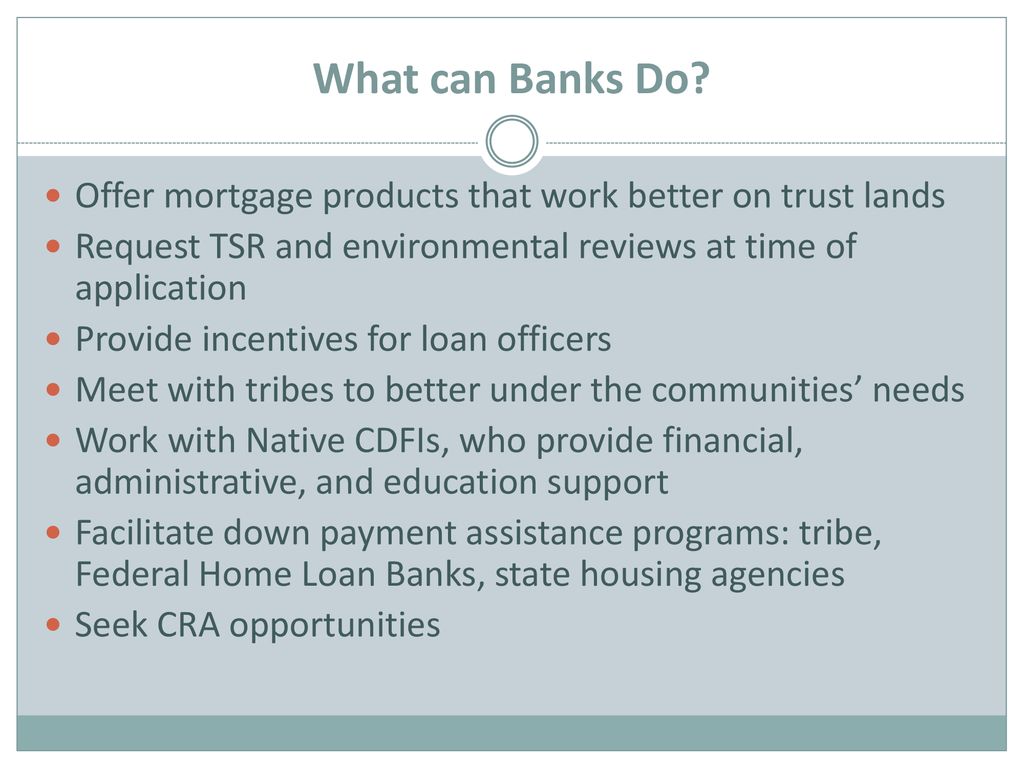

- Specialized Lenders: Seek out lenders who have experience working with tribal members and are familiar with HUD Section 184, VA NADL, and the nuances of trust land financing.

- Homebuyer Education: Participate in homebuyer education courses. These can provide crucial information on budgeting, credit, the mortgage process, and home maintenance. Many programs, including Section 184, encourage or require this.

- Credit Building: While some programs offer flexible credit, a stronger credit score always opens more doors and can lead to better interest rates.

- Leasehold Agreements: For homes on trust land, understanding the leasehold agreement (terms, duration, renewal) is critical. Lenders will review this carefully.

Purchase Recommendations

Based on the review, here are our top recommendations for tribal members:

-

Start with HUD Section 184 (Primary Recommendation for Trust Land):

- Why: It is specifically designed for you, addressing the unique challenges of trust land. It offers low down payments, flexible credit, and competitive rates without the lifetime PMI of FHA.

- Action: Contact your tribal housing department or a HUD-approved Section 184 lender early in your process. Verify your tribe’s participation.

-

If a Veteran, Explore VA Loans, Especially NADL (Strong Secondary/Primary for Veterans):

- Why: 0% down, no PMI, and excellent rates make VA loans incredibly powerful. The VA Native American Direct Loan (NADL) is the option for veterans on trust land.

- Action: Obtain your Certificate of Eligibility (COE) and research lenders experienced with VA loans, particularly NADL.

-

Consider FHA or USDA Rural Development (Excellent Alternatives for Fee Simple Land or Specific Circumstances):

- Why: These are great options for tribal members buying homes on fee simple land (on or off reservation) who need low down payment and flexible credit. USDA is particularly strong if the property is in a qualifying rural area.

- Action: Check property eligibility for USDA. Be aware of FHA’s lifetime MIP.

-

Conventional Loans (Best for Strong Credit & Fee Simple Land):

- Why: If you have excellent credit, a substantial down payment, and are purchasing fee simple land, conventional loans can offer competitive rates and more flexibility.

- Action: Compare conventional rates and terms with government-backed options, especially if you can put 20% down to avoid PMI.

Conclusion

The path to homeownership for tribal members is rich with opportunity, particularly through programs specifically designed to support their unique circumstances. The HUD Section 184 Indian Home Loan Guarantee Program stands out as the most tailored and advantageous option for many, especially those looking to build or buy on trust land. For veterans, the VA loan, including the Native American Direct Loan, offers unparalleled benefits. FHA and USDA loans provide solid alternatives for those purchasing on fee simple land or meeting specific geographic/income criteria.

The key to a successful homeownership journey lies in thorough research, engaging with tribal housing authorities, seeking out specialized lenders, and understanding the critical distinction between trust land and fee simple land. By leveraging these resources and choosing the right mortgage option, Native American tribal members can confidently achieve their dream of owning a home and building lasting generational wealth.