Maxlend Tribal Loans: A Comprehensive Review of a High-Cost Lending Solution

In the often-turbulent waters of personal finance, many individuals find themselves in desperate need of immediate funds. When traditional banking avenues close their doors due to low credit scores, insufficient collateral, or a lack of banking history, alternative lending solutions emerge. Among these, tribal loans, such as those offered by Maxlend, have carved out a niche. These loans promise quick access to cash, often with less stringent eligibility criteria, but come with a complex set of advantages and disadvantages that prospective borrowers must understand.

This 1200-word review delves deep into Maxlend Tribal Loans, examining their operational model, exploring their benefits and drawbacks, and ultimately offering a comprehensive recommendation for those considering this financial path.

Understanding the Landscape: What Are Tribal Loans?

Before dissecting Maxlend specifically, it’s crucial to grasp the concept of tribal lending. Tribal loans are short-term, high-interest installment loans offered by lending entities owned and operated by Native American tribes. The key differentiator for these lenders is their claim of sovereign immunity, meaning they operate under tribal law rather than state law. This allows them to bypass state-specific usury laws that cap interest rates, enabling them to charge significantly higher Annual Percentage Rates (APRs) than conventional lenders.

This model was designed to foster economic development within Native American communities. However, it has also become a contentious area, with consumer advocates often criticizing the high costs and the perceived lack of consumer protection for borrowers. Maxlend operates within this framework, positioning itself as a direct lender offering a lifeline to those struggling to secure financing elsewhere.

Maxlend Tribal Loans: What They Offer

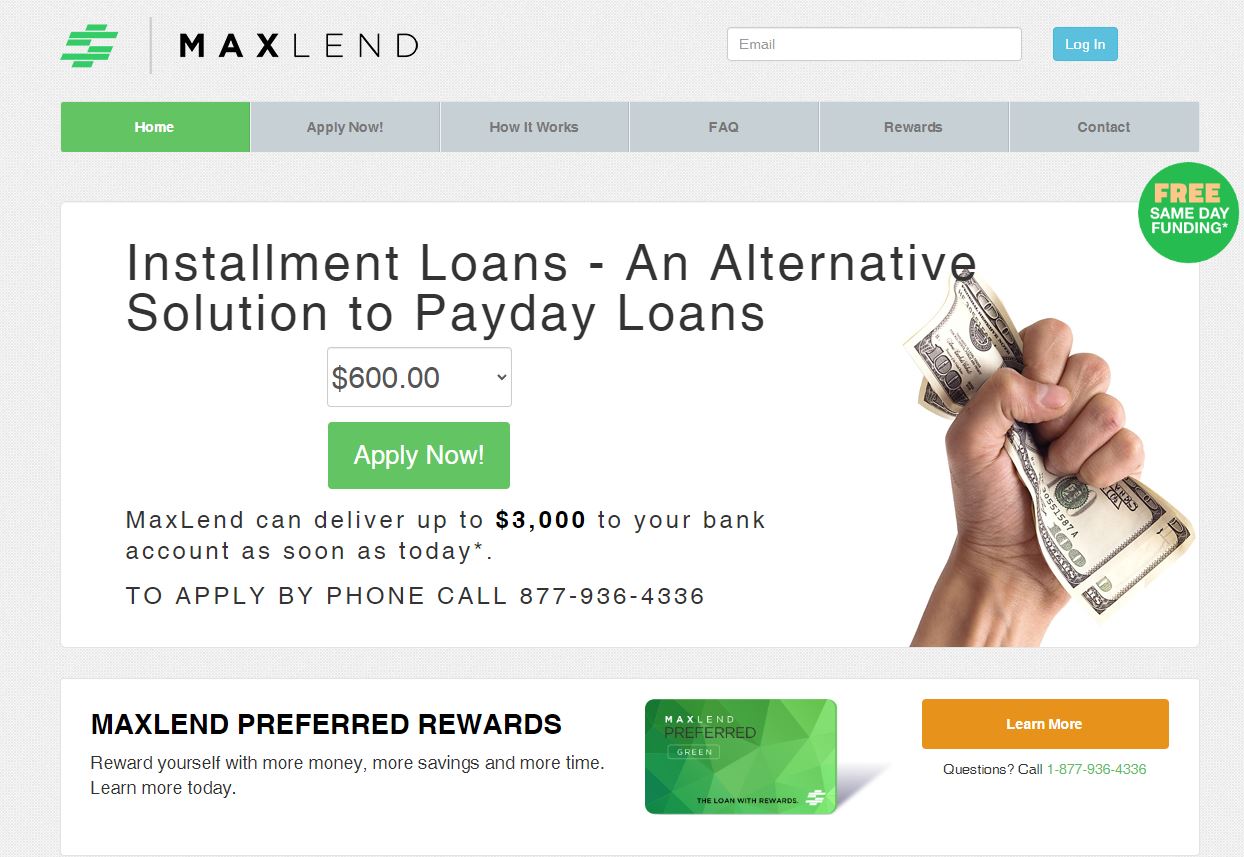

Maxlend typically offers installment loans, which differ from traditional payday loans in their repayment structure. Instead of a single lump sum repayment on your next payday, Maxlend loans are designed to be paid back over several weeks or months through a series of scheduled payments.

Key characteristics often associated with Maxlend Tribal Loans include:

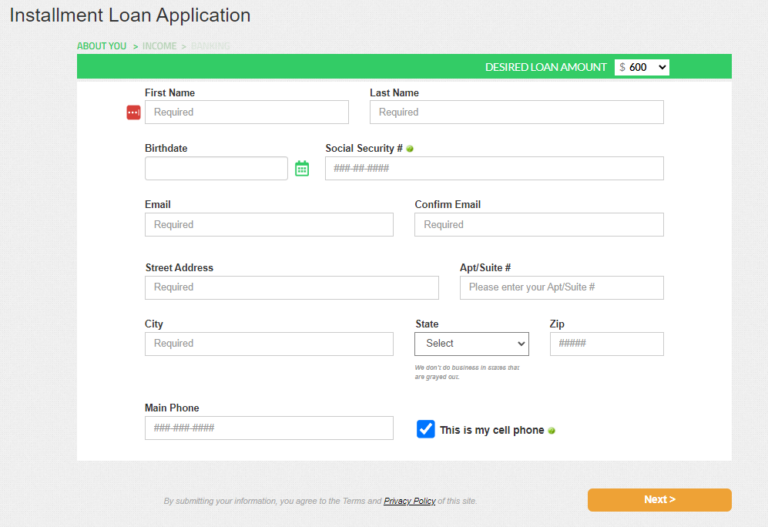

- Online Application: The entire process, from application to approval, is typically conducted online, emphasizing convenience and speed.

- Rapid Funding: Approved applicants often receive funds directly deposited into their bank accounts within one business day, addressing urgent financial needs.

- Flexible Eligibility: Maxlend, like many tribal lenders, tends to have more lenient eligibility criteria compared to traditional banks. This often means they are accessible to individuals with poor credit scores, limited credit history, or those who have been rejected by mainstream lenders.

- Installment Repayment: Loans are structured with multiple payments spread over a period, making the individual payment amounts smaller than a single payday loan repayment, though the total cost can be significantly higher.

- Direct Lender Status: Maxlend positions itself as a direct lender, meaning you are dealing directly with the loan provider rather than a broker.

The Advantages of Maxlend Tribal Loans

For a specific segment of the population, Maxlend Tribal Loans can appear to be a viable, even necessary, solution. Here are the primary advantages:

-

Accessibility for Bad Credit Borrowers: This is arguably the most significant benefit. For individuals with credit scores that fall below traditional lending thresholds, or those with no credit history at all, Maxlend offers an avenue to secure funds that would otherwise be unavailable. They often focus less on credit scores and more on the applicant’s ability to repay, usually verified through stable income.

-

Speed and Convenience: Financial emergencies don’t wait for bank processing times. Maxlend’s entirely online application process, coupled with rapid approval and next-day funding, can be a critical advantage for those facing urgent expenses like medical bills, car repairs, or utility cut-offs. The convenience of applying from home, without extensive paperwork or in-person visits, is also a draw.

-

Installment Repayment Structure: Unlike traditional payday loans that demand a full repayment in one go, Maxlend’s installment model can feel more manageable. Breaking down the total amount into smaller, more frequent payments can alleviate the immediate pressure of a large lump-sum payment, potentially making it easier for borrowers to budget.

-

No Collateral Required: Maxlend loans are typically unsecured, meaning you don’t need to put up any assets (like a car or home) as collateral. This reduces the risk of losing valuable possessions if you default on the loan.

-

Emergency Lifeline: In dire situations where all other options have been exhausted – no savings, no credit cards, no help from family/friends – a Maxlend loan can provide the immediate cash needed to avert a crisis, such as eviction or utility disconnection.

The Disadvantages of Maxlend Tribal Loans

Despite the perceived benefits, the drawbacks of Maxlend Tribal Loans are substantial and, for most borrowers, far outweigh the advantages. These disadvantages primarily revolve around cost, long-term financial implications, and regulatory concerns.

-

Exorbitant Interest Rates (APRs): This is the single largest red flag. Due to their tribal affiliation and sovereign immunity, Maxlend and similar lenders are not bound by state usury laws. This allows them to charge APRs that can range from 400% to well over 700% or even higher. To put this into perspective, a typical credit card APR is between 15-30%. A $500 loan, repaid over several months at such high rates, can easily end up costing $1,000, $1,500, or more in total.

-

High Fees and Rollover Charges: Beyond the astronomical interest rates, borrowers may encounter various fees, including origination fees, late payment fees, and insufficient funds (NSF) fees. While Maxlend typically offers installment loans, some lenders in this space allow "rollovers" or "renewals" where you pay a fee to extend the loan term. This traps borrowers in a cycle of debt, as they continuously pay fees without significantly reducing the principal.

-

The Debt Trap Cycle: The combination of high interest rates and fees makes it incredibly difficult for borrowers to escape the debt. Many find themselves paying off one loan only to immediately take out another, or struggling to make payments, leading to late fees and increasing principal. This can quickly spiral into a long-term financial burden that exacerbates their original financial difficulties.

-

Lack of State-Level Consumer Protection: While tribal lenders often adhere to federal regulations (like the Truth in Lending Act), their sovereign status means state consumer protection laws regarding interest rate caps or licensing often don’t apply. This can leave borrowers with fewer avenues for recourse if disputes arise or if they feel they have been exploited.

-

Impact on Financial Health: While Maxlend might offer a temporary solution, the long-term impact on a borrower’s financial health can be devastating. The significant portion of income dedicated to loan repayments can prevent individuals from building savings, paying off other debts, or improving their credit score. It can perpetuate a cycle of financial instability.

-

Transparency Concerns: Although reputable tribal lenders aim for transparency, the complex nature of high-interest loans, coupled with the potential for fees, can make it difficult for borrowers to fully understand the true cost of their loan and their repayment obligations. It requires meticulous reading of the fine print.

Who Are Maxlend Tribal Loans For?

Given the stark contrast between their advantages and disadvantages, Maxlend Tribal Loans are suitable for an extremely narrow demographic, and only under very specific, desperate circumstances.

They are primarily for individuals who:

- Have exhausted ALL other conventional and unconventional lending options.

- Are facing an absolute, immediate financial emergency (e.g., imminent eviction, essential utility shut-off, critical medical need) that must be addressed immediately.

- Have a guaranteed, clear, and realistic plan to repay the loan quickly and completely according to the agreed-upon schedule, minimizing the impact of high interest. This often means having a known source of funds (e.g., an upcoming bonus, a settlement) that will cover the entire loan amount soon after borrowing.

They are emphatically not for:

- Long-term financial solutions.

- Discretionary spending or non-essential purchases.

- Individuals who are unsure if they can meet the repayment schedule.

- Anyone who has other, more affordable lending options available.

Alternatives to Consider

Before even considering a high-cost tribal loan, borrowers should exhaust every possible alternative:

- Personal Loans from Credit Unions or Banks: Even with imperfect credit, some credit unions or online lenders offer personal loans with significantly lower APRs.

- Payday Alternative Loans (PALs): Offered by federal credit unions, PALs are small loans ($200-$1,000) with much lower APR caps (currently 28%) and more flexible repayment terms than traditional payday loans.

- Borrowing from Friends or Family: While potentially awkward, this is often the cheapest option if available.

- Community Assistance Programs: Many non-profits, charities, and government agencies offer assistance for rent, utilities, food, or medical expenses.

- Negotiate with Creditors: If the emergency is an overdue bill, try to negotiate a payment plan with the creditor directly.

- Credit Counseling: A non-profit credit counselor can help assess your financial situation and explore options.

- Emergency Savings: This is the ideal solution, highlighting the importance of building an emergency fund.

- Pawn Shop Loans: While still high-cost, these often have lower APRs than tribal loans, and you risk only the collateral, not deeper debt.

Purchase Recommendation

Our recommendation for Maxlend Tribal Loans is a strong word of caution, leaning heavily towards avoidance for the vast majority of borrowers.

While they offer a rapid solution for those with poor credit in dire emergencies, the exorbitant interest rates and potential for a debt trap are extremely high. The financial cost of these loans can easily dwarf the principal borrowed, leading to long-term financial distress.

Therefore, we recommend Maxlend Tribal Loans ONLY as an absolute, last-resort option, and only under the following strict conditions:

- You have explored and exhausted ALL other available alternatives.

- You are facing a critical, time-sensitive financial emergency that cannot wait.

- You have a concrete, guaranteed plan to repay the loan in full, including all interest and fees, by the very first due date or as quickly as possible. This means you are certain of an incoming sum of money that will cover the entire debt without causing further financial strain.

- You fully understand the loan terms, including the APR, total cost of the loan, and repayment schedule, and are prepared for the significant financial burden.

For anyone else, especially those looking for a general financial solution or those unsure about their ability to repay quickly, Maxlend Tribal Loans are not a recommended choice. The risks of falling into a debilitating debt cycle are simply too high. Prioritize exploring every other more affordable and financially sustainable option before considering a high-cost tribal loan. Your long-term financial well-being is paramount.